Client-focused Solutions

The relationships we build with our clients are based on trust, confidentiality and professionalism.

Starting with the first opportunity we have to speak with you as a prospect and throughout the life of our relationship, Doviandi is focused on you, the Client.

We listen in order to understand your current circumstances and future aspirations. Using this information we create tailor-made solutions aiming to maximize business growth and investment potential whilst minimizing tax burdens.

Our fees are presented clearly for acceptance prior to embarking on any assignment.

We are very willing to work with your advisors, including tax lawyers, accountants and business consultants to get an in depth understanding of your situation or to implement and manage the structure they have prepared for you.

Due Diligence

It is a legal requirement to carry out due diligence, “Know Your Client” (KYC) procedures. At Doviandi, we take these policies as an opportunity to gain in-depth understanding of our clients and their service requirements.

The following information will be requested as part of our due diligence process:

- An understanding of the source of funds for the proposed business operations

- Certified passport copies, recent utility bills and bank or professional reference letters on individuals involved in the proposed structure

- Certified corporate documents (i.e. certificates/registers of shareholders and company officers) on all corporate entities involved in the proposed structure

All information is treated with the utmost confidentiality.

Client Onboarding

We have streamlined our client onboarding procedure to enhance your experience. A comprehensive set of documents to identify your specific service requirements in combination with step-by-step guidance will ensure a smooth client engagement process.

Open Communication

Communication is key to any successful relationship.

Once your company, or other structure, is set up, our multilingual team of corporate service officers, accountants, lawyers and tax professionals will ensure that you extract maximum financial value from our arrangement.

Whenever you have a question, concern, suggestion or problem you will be able to speak directly with senior management to resolve any issue in a timely manner.

Our Clients

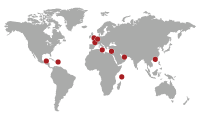

Our clientele is typically looking for tax planning and optimization, and a safe pair of hands to manage their tailored solutions. They are individuals and corporates who now enjoy the benefits offered by cross-border structuring.

Their tailor-made structures facilitate and optimise the capital flows in and out of the following countries/regions:

- Russia and the Commonwealth of Independent States (CIS),

- EU including Poland, Hungary, Romania, Czech Republic, Latvia, the UK, Luxembourg, Greece and the Netherlands

- India and China

- The Middle East

Tax planning vehicles used

The cooperation with our clients is as tailor-made as the tax solutions we manage for them:

- Holding Companies

- Group Finance Companies

- Intellectual Property (IP) owning companies

- Real Estate holding companies

- Companies trading in Financial Securities

- Ship management and ship owning companies

- Cyprus International Trusts

- Cyprus Alternative Investment Funds (AIFs)